Exclusive For Australian Teachers Looking To Save On Their Home Loan

DISCOVER HOW TEACHERS COULD SAVE UP TO $100,000* WHEN REFINANCING THEIR HOME LOANS

Apply for your free 'Teachers Only Mortgage Review' to see exactly which how much you could save on your mortgage.

Completely free to explore.

No strings attached.

Teachers... It's Time To Get A Better Rate And Fairer Deal On Your Mortgage

While you’re working hard to build a life, your mortgage could be quietly holding you back.

A big slice of your income vanishes into your home loan… and chances are, you’re paying way more than you need to.

Most teachers are.

You bought the home, made the repayments, made some improvements, stuck it out.

But your bank hasn’t reviewed your equity position, so you’re probably not getting the best rate.

Because here’s the truth

1

You're Probably Overpaying On Your Mortgage. While others are scoring rates under 6%, you could be handing your bank thousands.

2

Banks Don't Want You To Switch. Why would they? They make more money when you remain complacent.

3

Refinancing Sounds Like a Headache. Paperwork, phone calls, hold music... no thanks. So you delay refinancing, and the extra cost keeps stacking up.

Don't delay any longer, and book your free call below.

How Are Teachers Saving Thousands On Their Mortgage

Let’s keep it simple.

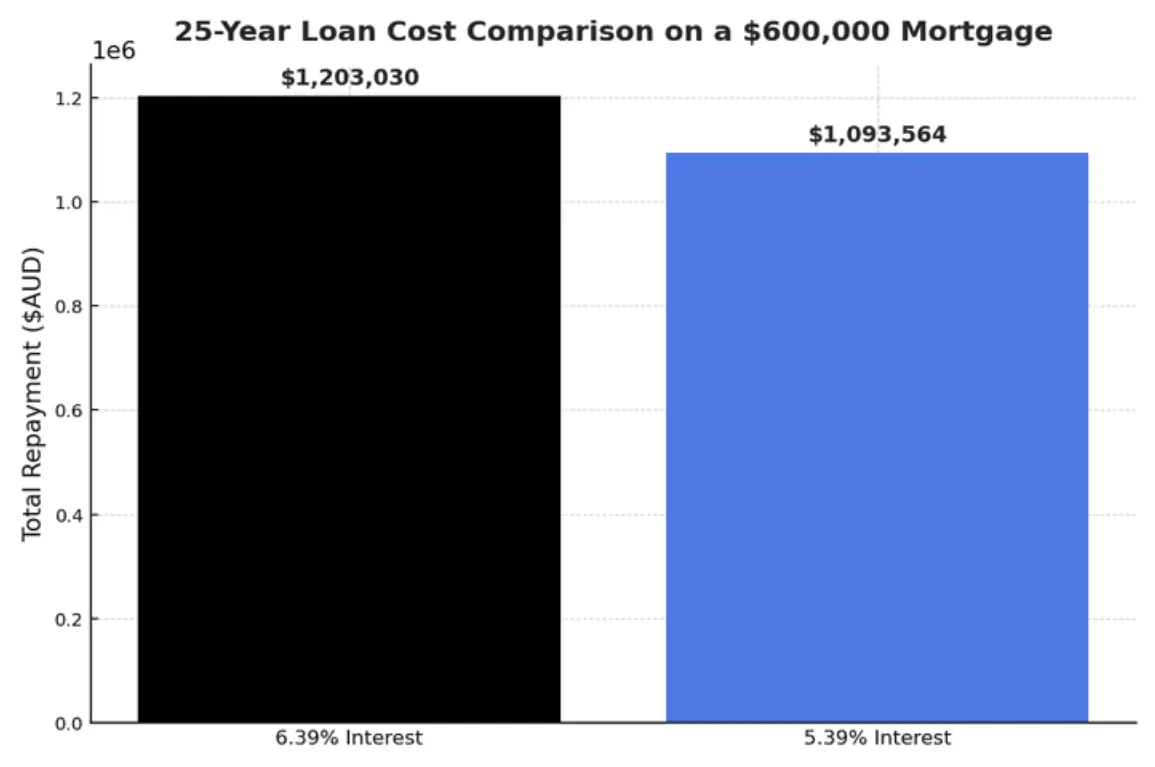

If we can reduce your rate by even 1%, the savings really add up and will start from month 1.

Take a look at our example below:

On a $600,00 loan, you could save more than $109,465 in interest.

That’s real money staying in your pocket, not going to the bank.

And it gets better…

Some lenders are currently offering cashback just for making the switch.

That’s money saved and money in hand...

All for choosing a smarter deal.

Disclaimer: Example based on a $600,000 loan over 25 years. Savings are illustrative only and depend on your personal situation, lender policies, and rates available at the time. Cashback offers vary and are subject to eligibility.

Recent Homeowner Wins Helping Aussies Just Like You

Penny W

Cannot recommend enough! The finance brokers have been with us on our two, nearly three year journey.

They've been a massive help along the way, with no question too silly or trivial, AND he's reviewed our options along the way to ensure we got the best mortgage that suits our needs.

Jonathan Schloss

Couldn’t thank the guys enough. I was very hesitant at first as I have only ever dealt with big banks.

But as soon as spoke with their team my concerns disappeared, the professionalism and care the team take towards me and my finances is unheard of. Big thanks to Chase who I dealt with mostly as he really took his time to explain every process and step to me.

Relle C

I’ve had a great experience working with Chase. He is very professional, knowledgeable, and always responsive, unlike previous brokers i've spoken with. Chase took the time to understand my goals and provided clear, tailored advice that made me feel confident about my financial decisions. Highly recommend!

Anthony Behan

My partner is on leave. Money was tight and I felt scared. They reviewed options many times to make sure it fit us. Chase helped me create a realistic budget, consolidate high-interest debts & have advice on how to rebuild my credit. Every step was clearly explained. Chase prioritised my long term stability over quick fixes.

Mia Thompson

I am new to refinancing. I felt silly asking things. Chase said no question is silly. They used plain words and simple pictures. They checked our choices again and again, so I felt sure. We picked a better loan and saved money. I feel proud and calm now.

Ruby Wright

Chase helped me as a casual teacher. Other banks said no or made it hard. Chase looked at my hours and pays, and explained what the lender needs. They checked options along the way so I felt safe. We got the loan changed and my bill is lower now.

Every Day You Wait, You’re Bleeding Profits and Losing Deals

You’ve found the perfect site.

The numbers stack up.

But then—the funding stalls.

Banks drown you in red tape, private lenders slap on sky-high interest rates, and your project? Dead in the water.

Each delay sends costs spiralling—holding expenses, rising interest rates, and supplier prices creeping up by the day.

The longer you wait, the thinner your margins get, turning a once-profitable project into a financial headache.

Deadlines loom, budgets blow out, and suddenly you're scrambling to plug gaps just to keep things afloat.

While you’re battling delays, your competitors are closing deals, breaking ground, and cashing in.

The sites you scouted? Gone.

The profits you planned for? In someone else’s pocket.

Months of planning, negotiations, and site analysis? Wasted, all because the funding didn’t come through.

But it doesn’t have to be this way.

Hi, I’m Michael, Director at Balcombe Financial.

We help property developers secure the funding they need to acquire, build, and complete high-return developments—without the usual financial roadblocks.

Whether you’re working on a small subdivision, a large-scale apartment complex, or a commercial development, we tailor solutions that move your projects forward fast and with maximum flexibility.

With access to over 40+ bank, non-bank, and private lending solutions, we unlock flexible terms, maximise your loan amounts, and keep your projects moving from acquisition to completion.

“Michael found me a loan that others said wasn't possible”

- John Zambelis, Victoria

“Michael’s professional services were key in securing the finance on our commercial development in a tight timeframe”

- Casey Landman, Victoria

No more missed deadlines. No more compromises.

Just streamlined, stress-free financing that lets you scale your portfolio, maximise your profits, and build long-term wealth.

Ready to secure the capital you need—fast and stress-free?

Apply for your free 'Get Funded' Consultation with Victoria’s top property development finance experts.

We’ll never leave it up to algorithms or call centre staff to future growth of your projects.

In this complimentary 20-minute session, we’ll help you:

1

GET A FINANCING STRUCTURE BUILT FOR YOUR PROJECT:

Discover the exact funding solution for your development goals—no more ‘one-size fits all’ loans that don’t fit your needs.

2

SECURE FAST APPROVALS WITHOUT THE USUAL ROADBLOCKS: We’ll map out how to cut through lender red tape and get your project moving—before delays eat into your profits.

3

FUND YOUR PROJECT WITH LESS OF YOUR MONEY: We’ll show you how to secure financing with minimal personal capital and more lender flexibility than you thought possible.

4

WALK AWAY WITH A CLEAR, ACTIONABLE FUNDING STRATEGY: Get a clear, actionable financing strategy tailored to your development—no fluff, no wasted time, just the exact next steps to get funded fast.

Spots are limited, and projects are moving fast.

Don’t let another opportunity slip through your fingers— apply for your free ‘Get Funded’ Strategy Session today and secure the financing you need before it’s too late.

To your success,

Completely free to explore.

No strings attached.

How Smart Developers

Get Funded

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Hidden Cost or Downsides of Competitors]

[Customer Support/Service]

B

Comparison #1

Comparison #1

100% Free, No-Obligations

Got Questions?

We’ve Got the Answers

Who is this for?

Homeowners who want a clearer, cheaper loan. We work with teachers and education staff, but anyone can check options.

Do you charge me?

Most of the time, no. If you choose a loan we arrange, the lender pays us a commission. If any fee ever applies (for example, a very complex case), we’ll tell you upfront in writing before you decide. By law, we must act in your best interests, and we’ll explain how we’re paid in plain English.

Can casual or contract teachers refinance?

Sometimes yes. Some lenders may consider regular relief or fixed-term income; we help present it clearly and check policy first.

How long does refinancing take?

Most files finish in about 4–6 weeks. Timing depends on valuation, lender queues, and your current bank’s discharge process.

Can I use equity for renos or debt consolidation?

Possibly. It depends on the property value, your income, and lender rules; we show the pros, cons, and total cost.

What loan features can help teachers?

Offset, redraw, and split loans can add flexibility for term-time cash flow. We explain in plain English and show simple examples.

Apply for Your Free 'Teacher Refinance Check' Today, and Discover Exactly How Much You Could Save From Refinancing.

In just one phone call, find out how you can refinance with confidence, without missing out on any teacher specific offers, rates, or lender benefits.

Our Service Will Help Decrease Burning Problem By Quantifiable Measure Or Penalty

We’re so confident in our ability to [Achieve Outcome] that we’re taking all the risk off your shoulders.

If we don’t [Specific Result Guarantee], you won’t pay a cent. No fine print, no hidden conditions – just a rock-solid guarantee to prove how committed we are to your success.

Because at [Your Business Name], we don’t just promise results. We guarantee them. If we don’t deliver, you don’t pay. It’s that simple.

100% Free, No-Obligations

Still Not Sure About Something?

Your 1st Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 2nd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 3rd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 4th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 5th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

100% Free, No-Obligations

Spots Are Filling Fast...

Claim Your Free Offer Name Today and Benefit

100% Free, No-Obligations

Credit Representative 477041 is authorised under Australian Credit Licence 389328.

Information is general only and doesn’t consider your objectives, financial situation or needs. Your full financial situation and requirements need to be considered before any offer or acceptance of a loan product. The savings estimate is based on refinancing a $600,000 loan over 25 years, from a 6.39% comparison rate to 5.39%. Actual results will vary. This example is for general illustration purposes only and does not constitute financial advice. Eligibility criteria, rates, cashback incentives, and lender-specific offers vary and are subject to change. Offers depend on individual borrower profiles and lender terms and conditions.